One of the biggest challenges of being an entrepreneur is managing your cashflow, especially while getting your business off the ground. If you are smart, before you strike out on your own you saved half a year’s worth of expenses and already began generating revenue through your business.

My suspicion is that very few people actually do this and also fail to plan decreased spending for the first few months as a self-employed worker. This definitely applied to me – we were saving, but in retrospect we were not saving nearly as much as we could/should have been and our spending rose in lockstep with our salaries. This is common, but in my opinion both irresponsible and avoidable.

Over the last 4-6 months, I have made a concerted effort to do a number of things:

- Better forecast my income each month, which is a moving target as a dual consultant and software entrepreneur.

- Better understand where our money was going each month, and seek to cut back in the ways that were not a part of our Rich Life (more on that further down).

- Cut back aggressively in the areas where we were spending too much, while continuing to allow ourselves to spend at the same rate for the things that bring us joy (travel, etc).

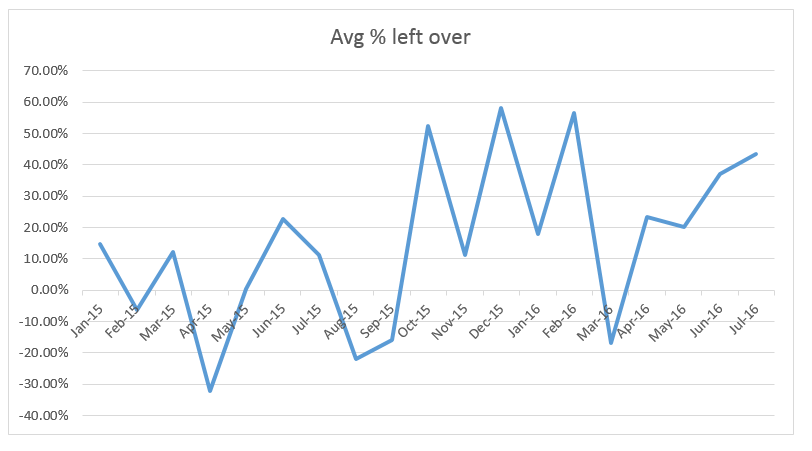

Here is our savings rate from January 2015 through June 2016:

Numbers have been removed for privacy’s sake, but you can clearly see two things:

- Margin on income vs spending was all over the place for 2015. I had a few big months in Oct/Dec/Feb based off severance and consulting and did no consulting Feb-April of 2016.

- Since we started really looking at our finances and cutting back spending on areas that do not bring us joy, our margin on income v spending has been steady and going up. July will be a good month for various reasons.

Where did we cut back?

When we sat down and looked at where we were spending, a few areas came up where we spend the most:

- Travel

- Restaurants

- Fixed expenses (rent/debt payments/car/cell phones/insurance)

When we discussed it, my wife and I both realized that we don’t get joy from going out to eat all the time or ordering take-out all the time. In reality, we were doing this because we were both exhausted from work every day (and from getting a dog in April 2014 and him taking a lot of time). We decided to cut back there and have by about 60-75%. This has made a huge difference and was basically what made or broke our margin each month.

We both love to travel and enjoy being able to do it to go see friends who live in other places. We decided that this is not an area where we want to cut back, though we do think much more carefully about taking last-minute trips. For example, we were thinking about going to Utah for my birthday recently, but decided against it because it felt like a lot of money right now. We are also getting more creative with how we get flights (using miles/looking for deals instead of just booking them) and where we stay (getting a house with friends during weddings as opposed to hotels or our own AirBNB). Instant savings there.

Finally, some fixed expenses are not possible to cut back on. You can’t pay less rent without moving (and we couldn’t move and pay less with our own place here in SF), we can’t pay less towards debt, etc. However, we did take a closer look at the other “fixed” expenses and found a few things:

- We were being overcharged by our car loan company because they thought we didn’t have auto insurance. We do. Sorted that out and saved $150 a month, plus the extra they’ve been charging us will be applied to the balance of our loan. So inadvertently we were paying down our car faster. Win!

- I renegotiated our cell phone contract by buying out my phone and taking advantage of some offers at Verizon. Saved $40/month right there, and also started putting half of our cell phone bill on my company because I use it primarily for business. So that saves us $100/mo right there as well.

Even if you think your fixed expenses are “fixed”, you can usually find ways to decrease them or find where you are being overcharged. Also look into your recurring expenses/subscriptions and see what you no longer use but are being charged for. For example, I was spending ~$40/mo on coffee. I started using a subscription coffee service called DriftAway and now spend $24/mo and fresh roasted coffee is delivered to me every two weeks.

Saving money and increasing convenience at the same time? Yes please!

Why does lifestyle creep happen?

Lifestyle creep, loosely defined, is when your expenses rise to meet your income. You’re making more, so you feel comfortable going out to eat more, traveling more, etc and before you know it, you’re making great money but you have no more in savings. The average millennial (I am an old millennial) has less than $1000 in savings, and there is a rise of broke, hungry, yet on trend professionals.

Lifestyle creep happens because we get lazy. We’re making more, so we can spend more. After all, isn’t that the purpose of increasing your income – to be able to spend more to acquire more stuff to live the American dream?

Well, the American Dream is a sham. We’ve all seen that – real estate markets go bust and the bankers who caused it don’t get in trouble, the stock market goes down for no apparent reason, and more things don’t make us happier.

But lifestyle creep happens because we think it will. We’re trying to keep up with the Joneses, when in reality the Joneses are swimming in debt and want you to be as well. I recently saw a thread on Reddit talking about feeling the desire to have a big house and nice cars like their friends, but when they had a chat with those friends they found out that they are swimming in debt, feeling trapped by their too-large house and too-fancy cars. They’re not happy.

Lifestyle creep happens when we buy into someone else’s dream and try to afford that. We don’t live within our means.

There are a lot of areas in which we do this – houses, money, careers. We stay somewhere because it’s where we are supposed to be. But why not buck against that?

How Do I Avoid Lifestyle Creep and Budget?

Avoiding lifestyle creep on the surface sounds easy – don’t increase your spending as your income increases. Easy, right?

In reality, it’s hard. In order to avoid lifestyle creep, you have to know exactly where your money is going each month.

Here’s what we did:

- Sit down with Mint.com during Finance Night.

- Look at income monthly over the last 6 months, then compare to expenses.

- Make sure that all of your transactions are categorized correctly so that you properly understand where your money is going.

- See where you have been spending the most and why (and if you can cut that down or not).

- Set a budget for each area of your life (rent, car, restaurants, travel, etc) for the coming month.

- At the end of the next month, see how you did. Rejigger budgets for the next month as needed.

Sounds simple? Because it really is. If you know how much you can spend in a certain area each month, then even when your income rises you’re not focused on that – you’re focused on your expenses each month. Eventually, it almost becomes a game to see how much under your budget you can spend while still keeping happiness high.

What’s a “Rich Life” anyways?

When I mention the notion of a “rich life” (which comes from Ramit Sethi), they often think I am talking about making a bajillion dollars.

The truth is very different. A Rich Life is about being able to do the things that bring you outsized joy while also cutting back aggressively on your spending in the categories that do not bring you joy. From Ramit:

A Rich Life can let you travel, spend time with your family, buy your time back (e.g., by hiring someone to clean your apartment), and accelerate your results (like with a personal trainer). Source

Ever wonder why often the happiest people you see are those with the least, while the monetarily-rich people seem to be pretty unhappy and unsatisfied all the time?

It’s often because those with less are focused on what matters – family, health, etc – and not on the money.

Figure out what makes you happy and allow yourself to spend reasonably in those areas as finances permit. Cut back aggressively everywhere else.

Budgeting As An Entrepreneur and Freelancer

I bet many entrepreneurs and freelancers will agree with me here – budgeting as a freelancer is hard. I have it slightly easier because of how my software business works, but on the consulting side it truly can be feast or famine. Some months, or for a few months in a row, you may have a windfall of a bunch of clients who are all paying you well. You work yourself hard and make a lot of money. But then the next few months are a bit thinner – maybe one or two clients total.

This is where a budget really comes in handy, plus some finagling with your bank accounts to give yourself a semblance of consistent income. And if you want to get out of spreadsheets and try to forecast your runway graphically, give Cushion a go. I’ve not used it, but this is why it exists.

Bank Account Setup

My bank account setup is a bit complicated when you first look at it, but here’s how it works and I think is fairly straightforward:

- Personal (with my wife) checking account

- Personal self-employed (SEP) IRA.

- Emergency fund

- Tax bank account

- Investments

On the business side, I have this:

- Business Checking

- Business Investment Savings (for taxes only)

- Business PayPal account (for accepting some payments, never keep a large balance there)

I route all of my consulting through my sole proprietor LLC. Every month, this is what happens:

- 35% of all post-expenses revenue goes into the business savings account to cover taxes

- I take the balance of the consulting I have done that month as my personal income (owner draw)

- I also take 50% of the post-expenses profit as an owner draw

- The other 50% post-expenses stays within the company checking account to reinvest into the business

The most important part and the one that applies to everyone reading this is the first bullet. Always set aside your taxes before you pay yourself, and pay your quarterlies. The worst thing that could happen to you as a freelancer/entrepreneur would be to get to next year and have a huge tax bill that you cannot cover. This will scare you back to a “real job” quickly, and even then you’ll still have a huge tax bill you can’t cover. Always set aside taxes first.

I’ve recently gotten a lot more into personal finance and being much smarter with saving money. Our plan is as follows to make sure we are on stable ground and have money in the bank to cover expenses should I fall sick or if I have some down months of consulting:

- Get emergency fund (great post here) back up to 3-4 months of expenses.

- Once that is fully funded, put the money that was going there into SEP (Self EmPloyed) IRA. Can contribute a max of $52k a year pre taxes (!!)

- Wife keeps funding her 401k as much as possible with hope of maxing it out.

- Planning for a house down payment through e-fund and other investments.

I don’t really care which banks you use (I use a combo of Schwab/Wells Fargo/BOA). The important part is setting up separate accounts and automating money moving around each month so that you don’t have to think about it and you know it will be there. This is also a pro-tip for saving money – transfer it automatically and you won’t even miss it.

Other Ways to Save As An Entrepreneur/Freelancer

There are many other creative ways to save money as an entrepreneur/freelancer. Not all of these will apply to you and your current situation (or the life you want to have), but take them into account and see if you can/want to make them a reality.

Remote living/working

The digital nomad movement has picked up steam in the last few years. As Internet access becomes more ubiquitous and more travelers are also working from the road in their respective areas, it has become easier and easier to work remotely.

Remote living can be a fantastic way to both see the world and get work done at the same time. Many recommend staying in places at least a month before moving on, so that you get settled and into a productive routine and can get work done for a while before moving on.

Remove living/working is not for everyone and isolation/depression are very real in these circles, but if you are able to do it and have wanted to, maybe give it a shot. You can find places in SE Asia for under $40 a night if you do it right.

I wrote about working remotely here.

Get roommates

If you’re single (or your partner is cool with it), a great way to save money on housing costs each month is to either get roommates or, if you have it, rent out the lower part of your home. You could also put a spare room in your place up on AirBNB and welcome travelers to your home that way.

Some people prefer to live with roommates. Personally, I have no desire to have a roommate other than my wife. But I do know of friends who bought a house and rented out an apartment on their first floor, which makes them great side income and helps them pay their overall mortgage.

Move to a lower cost of living area

If you live in a super high cost of living area, probably the best way to save money is to move somewhere cheaper. I’ve met many people who moved from a high COL area to a lower COL area and cut their monthly expenses by 30%+. If you’re paying a lot to live in an area where you don’t need to be because you can work from anywhere you have an Internet connection, consider moving.

Sell Your Car

This one pains me to write because I love cars and I love my car, but if you don’t use your car much then it can feel crazy to pay $XXX a month for payment and insurance just to have it parked 98% of the time. If you can do it (and aren’t moving somewhere where you will need a car anytime soon), think about selling it.

For a bit more reading, here are some traditional ways: http://www.aol.com/article/2015/11/02/millennials-lifestyle-creep-saving-money/21256806/

What about you? How do you, as a freelancer/solo consultant/entrepreneur, manage your budgets, keep yourself sane, and know that you are going to be able to pay your bills while also saving for retirement?

Great post John! That is going to be helpful for a lot of people.

Excited to watch this journey! You are kicking tail my friend!

Good article John. I’m going through this myself and starting to pull everything back together. Love your term of late millennial, I feel the same 🙂

Love this article, John. As a millennial myself, this is actually something I’m terribly aware and afraid of. It’s so easy to spend once you’re finally not broke anymore!

I kinda like how you said it here John – that lifestyle creep happens because we get lazy… I think you’re right!

Great post, John! Might just be me, but isn’t $40/night pretty steep for SE Asia? I mean, I’ve never been, but most places don’t even cost $1200+/month to rent here in the UK (although admittedly I don’t have a pool).

PS. I ended up coming here from Twitter; maybe that spammy outreacher did you a favour after all!

You can definitely get them for cheaper, I am sure. Though $40/nt ($1200/mo) is less than half of what we pay per month in San Francisco, so I guess it is all relative and from your perspective. From mine, it’s super cheap, plus food and all those other costs are a lot less as well.

Yeah, I guess things are actually pretty cheap here in the UK as long as you stay well out of London, so like you say, it’s all relative. I was seriously looking into Chiang Mai – the classic “nomad” destination – around a year ago and it seemed crazy cheap (although I know a lot of people exaggerate how cheap it really is), but I remember seeing some pretty decent places for around $15-$20/night. However, being the rain/cold-accustomed Englishman I am, I’m just not sure I could stand the constant heat/humidity!