I’ve recently been doing a lot of reading, thinking, and having discussions with smart entrepreneurs about how companies grow and what it takes to build a successful company. As I’ve built Credo from nothing in October 2015 to approximately $350k ARR as I write this (numbers here) and growing, I’ve been through many levels of my own psychology and the psychology of others as I’ve fought to make this thing a reality and now to keep growing it.

Some posts have really caught my eye over the last number of months.

All of these are from companies that many entrepreneurs and digital marketers (I consider myself both) look up to and potentially use on a frequent basis (I use 3 of the 4):

The above posts are all worth a read and give you really good insight into what it takes to grow, operate, and make tough decisions as an entrepreneur. It’s not for the faint at heart. It’s actually some days really bone-crushingly difficult.

At the same time, I’ve seen some interesting questions on places like Twitter:

@randfish I’m afraid of running a biz that isn’t profitable for even 1 quarter, how might that fear be holding me back?

— Wil Reynolds (@wilreynolds) February 10, 2017

Wil Reynolds is the founder of SEER Interactive, and calls himself a “serial underdog”. He has that entrepreneurial fire in his belly (more on that here) and through that also seeks to realize his own blind spots. I respect Wil a ton.

I’ve also long been afraid of running a business that is not profitable, or operates so close to the line in order to grow that you’re pretty sure that you’ll make some mistakes and poof – your company will be gone. That thought is, in a word, terrifying when your company is your baby and you’re putting so much of yourself into it.

Stages of Business Growth

I want to point you to a video that Dan Martell did recently all about this topic, because it’s given me a lot of clarity around operating a business:

According to Dan’s framework, businesses go through cycles as they grow:

- Focusing on top line revenue – eg figuring out the sales engine

- Improving your gross profit by implementing cost controls

- Getting your message into the market (scaling attention)

Dan says it well:

You just keep cycling through each one and if you’re smart, you’ll be using quarterly themes so you can get the whole company behind it!

I’d say my business is somewhere between 1 and 2, especially as there are two sides to Credo with one monetized. I have to figure out two acquisition engines.

These are my insights.

Growth Experiments Are Expensive

Every company has to grow. Unfortunately, when you’re tackling a new business you’re often not sure what you’ll have to do in order to grow. You don’t know how much different growth levers are going to cost to pull because you haven’t yet discovered that the level exists.

Finding your company’s growth levers is time-consuming and expensive. As I’ve been building Credo, I’ve tried all of these:

- SEO (of course)

- Content marketing

- PR

- Facebook Ads

- AdWords

- Partnerships

Obviously some of these are expensive on your time (SEO, content) and others are expensive on your bank account (advertising), but they all cost something. When you’re trying them out, you have to be willing to spend money to learn lessons so you can spend your money in smarter ways later.

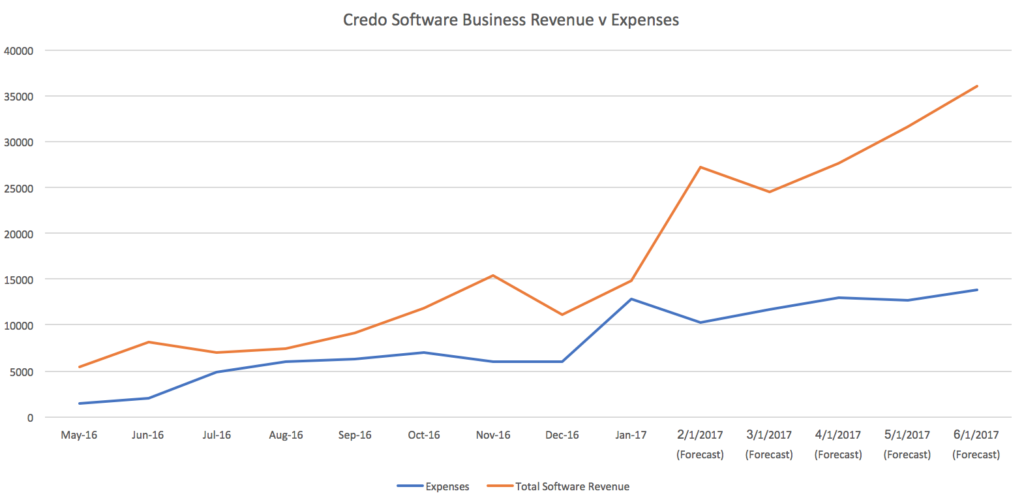

Credo costs have definitely grown over the last few months, with January being my biggest so far because of investments I made in learning and growing as an entrepreneur. Right now, Credo is operating at about break-even and I even paid myself a bit less for January because of that. And that’s a tradeoff I am willing to make right now as I look towards the future.

But that doesn’t mean it’s any less scary.

Cost Controls Are Hard

As you can see above, assuming Credo keeps hitting its numbers then costs are going to go up marginally but not nearly as fast as they have been or nearly as fast as revenue is projected to scale. This is even taking into account much higher development costs than I have had as well as bringing on a part-time executive administrative assistant to help out with a lot of tasks.

Choosing to double down on spending money to grow is scary for a bootstrapped company like mine. While I do have consulting revenue not shown here that I could use, the reality is that I do consulting for personal income and happiness (getting to work with cool brands) and that money is earmarked for other goals (buying a home, etc).

I respect how Nathan Barry got their costs under control with ConvertKit. They did all of the following:

- Renegotiated contracts (17% savings on credit card processing and $900/mo on email sends)

- Cut out $800 in unnecessary costs

- Improved processes to handle more customer support without growing headcount

- Improved infrastructure, which lets the dev team do more work without hiring more (expensive) developers

In his words:

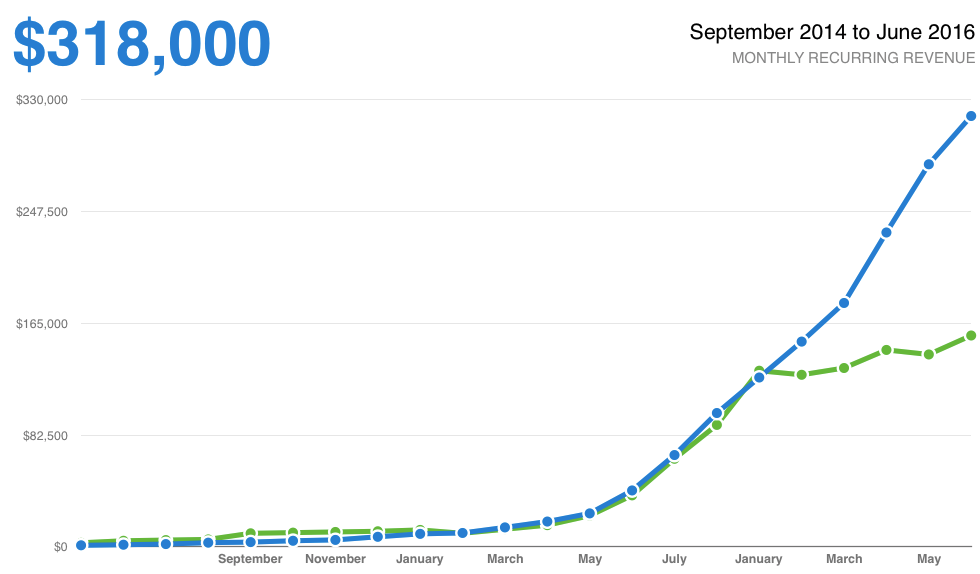

We saved up $538,000, beating our goal of $460,000 by $75,000. In May and June we pulled off over 50% in profit! The final profit in June was $162,000. I think that level of profit is unheard of for a fast growing startup.

The numbers speak for themselves:

Congrats Nathan and team, you now get to progress to step 3 before starting all over again 🙂

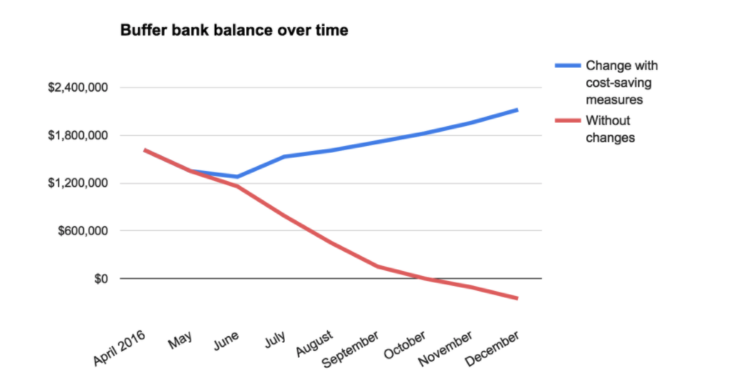

And to bring attention to Buffer, they showed it differently in terms of bank account balance but they made a complete reversal of fortunes and their bank account should be able to keep growing while also having cash on hand to finance growth if they need it without having to go back to VCs for an infusion of cash:

Scaling Attention Is Expensive

Once you’ve figured out your growth channels and their costs, and then optimized your business for profitability (of which there are many ways to do this, from increasing prices to cutting costs to many others. Revenue optimization is a whole different topic, and one that I am not qualified to talk about alone) now you get to really blow it out and scale attention.

The interesting psychology behind this is that now you’re used to spending money and you’ve also had to dig into your business numbers and so you have a good feel for where your money is going.

I imagine that this is where the real fun is. Sure, your expenses are continuing to grow. Look at ConvertKit. They drastically decreased how quickly they were burning cash, but their expenses still kept growing. I bet Nathan would say that this was totally acceptable to him and he was happy to do it.

Let’s Look At Amazon

One business I’ve always been fascinated by is Amazon. I mean, look at them. They are a $393B market cap publicly traded company. Their stock price is over $827 per share (and I expect a split at some point) (image via Google Finance):

Oh, and did I mention that they hired 100,000 people last year and are still on a hiring tear? They are making enormous investments in infrastructure and logistics, and the bet is paying off. At the same time, their businesses like Prime, AWS, and others are minting cash left and right.

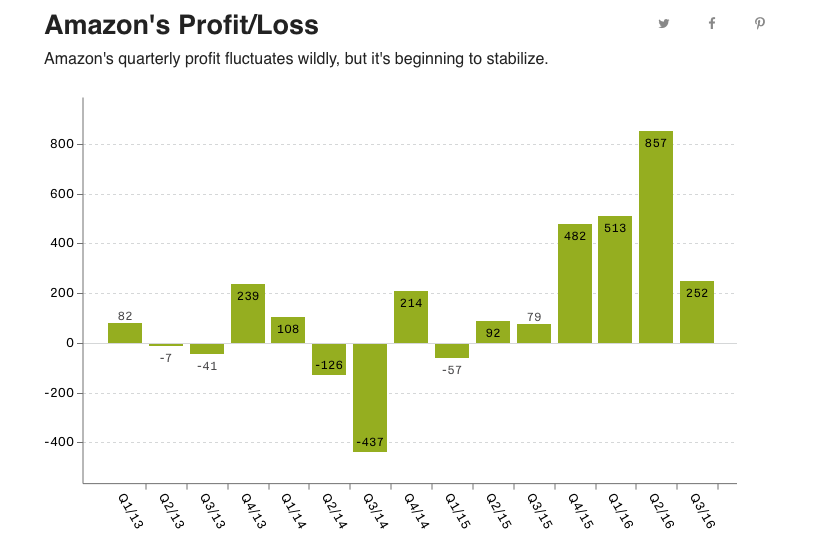

But let’s look at their profit over time. This is where they make me laugh (image via The Verge):

This looks like a really fun rollercoaster, the stomach-in-your-throat-as-you-plummet and then I-feel-like-gravity-is-stronger-now-because-we-are-rising-so-fast type of rollercoaster.

Amazon can make it rain with profit when they want to, and for a long time they were on an every-eight-quarters-or-so-print-cash continuum to, in my view, basically prove to investors that they could mint profit when they wanted but they purposefully were not.

Even Amazon isn’t off the cut costs/increase costs rollercoaster. It’s business.

I’m early on in my business. I look up to businesses like Moz and Buffer and ConvertKit because they are two steps (ConvertKit) to ten steps (Moz) ahead of where I am, and so I can learn a lot from them. At the same time, they can look up to bigger ones that are still on the same treadmill and learn from their challenges.

Business is fascinating, isn’t it?

It always helps spending a little to make a lot. It’s a matter of how to effectively spend money versus throwing money at things that won’t prove their worth. Great insight John.